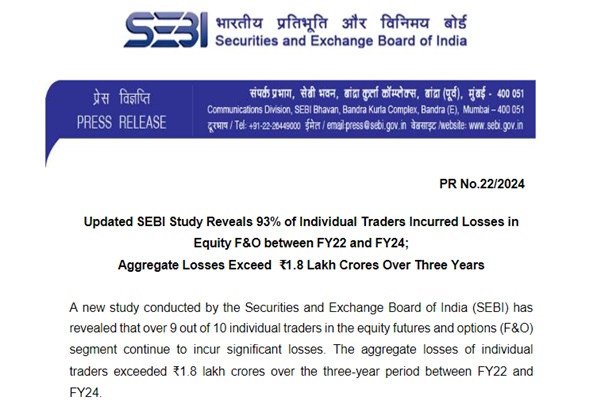

A study conducted by the Securities and Exchange Board of India has revealed that individual traders continue to incur severe losses in the equity futures and options (F&O) segment while proprietary traders and Foreign Portfolio Investors have succeeded in booking profits.

Considering the increased participation of individual investors in equity and equity derivatives markets, SEBI conducted this study to analyze profit and loss patterns for individual traders in the F & O segment from April 2021 to March 2024.

According to SEBI, the aggregate losses of individual traders exceeded 1.8 lakh crore rupees over this period. While just 7.2 per cent of individual traders managed to register a profit over three years, a mere one per cent of them could earn profits exceeding one lakh rupees after adjusting for transaction costs. Meanwhile, close to 93 per cent of individual investors incurred an average loss of around two lakh rupees.

On the other hand, proprietary traders and Foreign Portfolio Investors earned gross trading profits of 33 thousand crore rupees and 28 thousand crore rupees respectively in the financial year 2023-24. As per the study, most of the profits were generated by larger entities that used trading algorithms.

SEBI has noted that the proportion of young traders, who happen to be below the age of 30 years, has risen from 31 per cent in the financial year 2022-23 to 43 per cent in the financial year 2023-24. The study further reveals that more than 75 per cent of the loss-making traders continue trading in the segment despite consecutive years of losses.