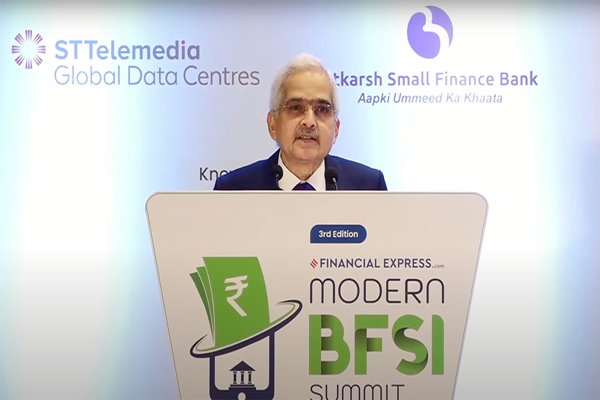

The Reserve Bank of India (RBI) Governor Shaktikanta Das has asked the banks to be watchful of the lag between credit and deposit growth and advised that the former should not exceed the latter. The Governor also warned that the financial system can get exposed to “structural liquidity issues” due to the lag between the credit and deposit growth.

Speaking at a private event in Mumbai on Friday, Mr. Das said the financial landscape in India is undergoing a structural transformation, and RBI is actively fostering innovations like UPI, reoriented payment systems to amplify reach and make a more inclusive financial sector in India.

He said the structural changes create opportunities as well as challenges. Therefore, financial institutions like banks, NBFCs and others need to carefully assess the impact of these changes on their business models, resilience and sustainability.

Amid concerns about mule accounts being used by fraudsters, Mr. Das asked banks to strengthen their customer onboarding and transaction monitoring systems to check unscrupulous activities. He added that the RBI is working with banks and law enforcement agencies to check Mule accounts and digital frauds.

Mr. Das said RBI’s actions on the unsecured lending have had the desired impact and growth in the focus segment has moderated, but flagged concerns on the high ceilings on unsecured lending kept by some banks despite having high exposures already. He advised prudence to such banks and added that they should avoid exuberance.